August Investment Newsletter

- Claude Machiha

- Aug 31, 2022

- 4 min read

Updated: Oct 17, 2022

Dollar bill continues to increase in purchasing power parity despite the Fed's aggressive tax hikes?; The economic fight to reduce Russian energy imports intensifies in Europe, but Germany the one to put her head on the block; Supply chain pressures increase in Africa overall, so do take care to order what you need online well ahead of time; Japanese wage growth is becoming quite the concern at a new inflation rate high of 2.6%; Australian manufacturing sector beginning to show resilience;

USD: DOLLAR BILL CONTINUES TO GAIN STRENGTH, DESPITE FED'S AGGRESSIVE TAX HIKING?

Surprisingly, amidst all the doom and gloom around the Fed's tax and interest rates behavior, the USD$ currency has managed to be at its strongest in just a little over 3 decades. A lot of buyers are seeking a safe-haven asset realm in the US and are divesting in the billions of USD$ each month away from most European-based funds, due to the ever increasing uncertainty dark clouding the Ukraine-Russia war conflict.

Whilst the dollar economy did contract by 1.4% in terms of gross domestic income (GDI) in Q2 of this year, some soft landing that was prophesied at the end of Q2 by Jerome Powell, the US Fed Chair, is currently being experienced.

EUR: GERMANY THE ONE TO PLACE HER HEAD ON THE BLOCK?

Marcel Fratzscher, one of Europe's leading economists who works for the German Institute for Economic Research has warned Reuters, that the actual economic cost to Germany that has arisen from the Russia-Ukraine conflict, will be approx. 3% per year, each year until the end of 2025. Every German is so concerned about having a colder winter due to the growing scarcity of gas, not by virtue of shortage however.

Hungary continues to stay strong in its audacious moral standpoint of view on importing Russian energy (gas, oil and electricity). The EUR reaches a two decade low of approx. 12% below parity against peering USD$ & GBP£. The euro zone's Purchasing Manager's Index (PMI) fell to 49.2 this past August from 49.9 in July (a figure below 50 indicates economic contraction).

ZAR: SUPPLY CHAIN PRESSURES INTENSIFY IN AFRICA OVERALL

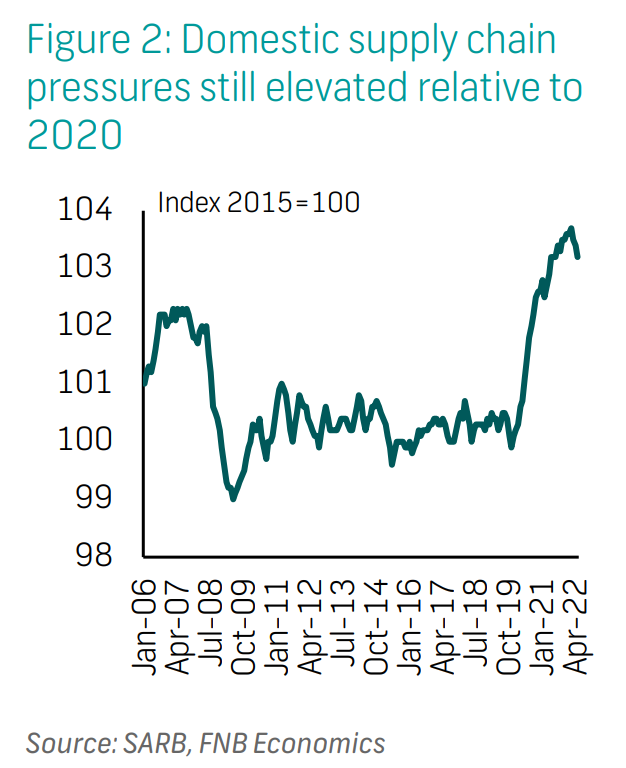

According to the South African Reserve Bank's (SARB) Composite Supply Chain Pressure Index (CSCPI), which primarily reflects domestic supply chain pressures within the Rand economy, supply chain pressures have increased due to local manufacturer's capacity utilization decreasing, i.e. they are making far less than they had expected or budgeted for.

This, as well as intermediate producer inflation on supply costs and load shedding has led to a 1.2% YTD decrease in South African manufacturing output. Retail sales continue to fluctuate, going up by a seasonally adjusted 0.6% m/m in April and going down by 1.0% m/m in May. Growth is expected in household consumption expenditure to average 2.7% by this year's end, due to an increase in credit spending.

GBP: BoE CAUTIONS ALL AGAINST HARROWING RECESSION TO COME

The latest UK Purchasing Manager's Index (PMI) has dropped to its lowest in since February 2021, a figure of 50.9, indicating a decrease in overall economic activity. 50 and below symbolize an economic contraction, meaning less spending, less jobs being filled or occupied, etc. Shockingly, one may say, the UK composite PMI, totaling both service and manufacturing sectors, has exceeded that of the Eurozone.

Perhaps due to the UK's rich deposit in internet businessmen & women. The Bank of England (BoE) continues to herald the economic recession in Q4 of this year, due to rising energy bills, which moreover many analysts believe will push the UK's Consumer Price Index (CPI) above 13% by October's end.

JPY: WAGE GROWTH BECOMING A SLIGHT CONCERN AT 2.6% JULY INFLATION RATE

The global price rises in fuel and raw materials has contributed generously to Japan's new eight-year high inflation rate of 2.6% this past July gone. The current cheerful prediction for Japan's economic growth is 1.6% for this fiscal year, and an estimated 1.3% for the 2023 fiscal year following.

Many of Reuters' economists have found that nominal wages in Japan may not increase with the current set of policies in force. The Japanese economy hasn't really seen any material wage growth in about 20 years. This is due to their world famous "Zen" approach to rate hiking policy. Japan has a rapidly ageing population, which in turn increases labor shortages year-on-year. This has put fire in the belly of various Japanese trade unions & labor associations to demand increased hourly rates for workers.

AUS: MANUFACTURING SECTOR EXPANDING OVERALL

Australia's PMI score of 54.5 in August showed a strong resilience and holding of the defensive line against global supply chain pressures so to speak, as it fell meagerly from 55.7 score recorded for July. A score above 50 indicates a better fairing than other peering major economics such as the USD$, EUR€, & GBP£. Australia's economy has managed to sustain their manufacturing output all round, so far this year, which is resultant of the increase in sales and administrative staff job openings over the last few months.

References:

Comments